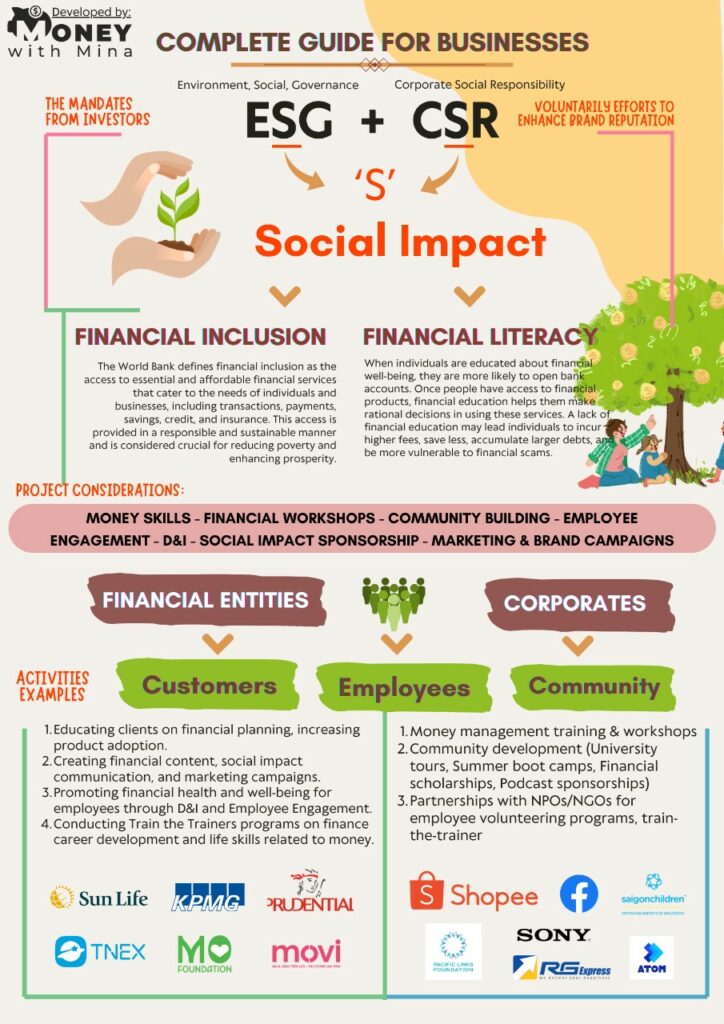

In this guide, we will explore how companies can launch Environmental, Social, and Governance (ESG) and Corporate Social Responsibility (CSR) initiatives to promote Financial Inclusion. Whether operating in the financial sector or other industries, companies can leverage various financial inclusion projects to align with the investor mandates, board requirements, or government entities.

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗜𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻:

It ensures access and usage to affordable financial products and services for individuals and businesses. According to the World Bank’s Global Findex 2021 Survey, only 71% of adults in emerging markets had a bank account, compared with 96% in high-income economies.

Specific examples of barriers:

* Living in rural areas limits access to opening a bank account.

* Existing health blocks access to buy insurance.

* Low-income individuals are not lucrative clients for investment firms.

* Small business facing challenges in securing a loan.

𝗪𝗵𝗮𝘁 𝗮𝗯𝗼𝘂𝘁 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗟𝗶𝘁𝗲𝗿𝗮𝗰𝘆?

Once people have access to financial products, financial education helps them make rational decisions in using these services. Programs that equip individuals with essential financial knowledge and skills will eventually enhance financial literacy. Based on research, a lack of financial literacy may lead individuals to incur higher fees, save less, accumulate larger debts, and be more vulnerable to financial scams.

𝗟𝗶𝗻𝗸𝗶𝗻𝗴 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗜𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻 𝘁𝗼 𝗘𝗦𝗚 𝗮𝗻𝗱 𝗖𝗦𝗥 𝗶𝗻𝗶𝘁𝗶𝗮𝘁𝗶𝘃𝗲𝘀

Businesses can integrate Financial Inclusion goals with ESG and CSR strategies to foster sustainable practices. Aligning with financial inclusion objectives not only benefits society but also strengthens relationships with clients and communities. Financial entities and non-financial corporations can contribute to advancing Financial Inclusion through tailored products, financial education programs, and community initiatives. Further details can be read here: http://surl.li/jpiipl

𝗔𝗰𝘁𝗶𝘃𝗶𝘁𝗶𝗲𝘀 𝗳𝗼𝗿 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀𝗲𝘀 𝘁𝗼 𝗖𝗼𝗻𝘀𝗶𝗱𝗲𝗿

I. Financial entities:

* Educating clients on financial planning, increasing product adoption.

* Creating financial content, social impact communication campaigns.

* Promoting financial health and well-being for employees through D&I and Employee Engagement.

* Conducting Train the Trainers programs on finance career development and life skills.

II. Non-financial companies can support financial inclusion by engaging in initiatives such as employee financial well-being programs, social impact sponsorships, employee volunteer programs, partnerships with NPO/NGOs who are actively in the Financial Inclusion space.

𝗜𝗺𝗽𝗿𝗼𝘃𝗶𝗻𝗴 𝗥𝗲𝗹𝗮𝘁𝗶𝗼𝗻𝘀𝗵𝗶𝗽𝘀 𝘄𝗶𝘁𝗵 𝗖𝗹𝗶𝗲𝗻𝘁𝘀 𝗮𝗻𝗱 𝗘𝗺𝗽𝗹𝗼𝘆𝗲𝗲𝘀

𝗖𝗹𝗶𝗲𝗻𝘁𝘀: Implement client education programs on money skills and planning to boost product adoption and retention for financial entities. This will foster stronger client relationships and positively impact the bottom line.

𝗘𝗺𝗽𝗹𝗼𝘆𝗲𝗲𝘀: ‘Financial Wellbeing’ workshops to enhance Employee Engagement, Lunch & Learn, and Diversity & Inclusion efforts.

𝗖𝗼𝗺𝗺𝘂𝗻𝗶𝘁𝘆: Educate communities on basic money skills through staff-led “Train the Trainers” programs before launching university tours.

𝗔 𝗰𝗮𝘀𝗲 𝗲𝘅𝗮𝗺𝗽𝗹𝗲 𝗼𝗳 𝗼𝘂𝗿 𝗰𝗹𝗶𝗲𝗻𝘁 𝗹𝗮𝘂𝗻𝗰𝗵𝗶𝗻𝗴 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗜𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

Money With Mina provided services to MO Money, a fintech company which is dedicated to championing financial inclusion and well-being for all. There are four (4) strategic approach includes:

– Increasing awareness and understanding of financial inclusion among internal staff.

– Integrating financial inclusion into key functions and messages.

– Aligning all functions within MO Money with the vision to promote financial inclusion.

– Consistently showcasing MO Money’s proud efforts in financial inclusion in all external communication and pitches.

Through these focused efforts, MO Money has demonstrated itself as a pioneer in the realm of Financial Inclusion, setting a new standard for industry excellence and social impact.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

Ready to drive meaningful change and foster financial inclusion within your organization? Partner with us today to empower your team, integrate financial inclusion into your operations, and showcase your commitment to a more inclusive financial landscape.

#ESG #CSR #FinancialInclusion #FinancialLiteracy #Community #Sustainability #SocialImpacts #MoneyWithMina #MinaChung #AnTamTaiChinh